Unlike gold, silver is used for a lot of things in manufacturing and other areas. According to economist Richard Daughty, there ‘re no stockpiles of silver left in globe.

Mostly these rings are designed in silver and gold or a combination of both the metals. Doable ! opt to any one among these. Once this trend started to design these rings in iron and gold but now these rings are getting more precious by designing it in gold ira rollover and silver coins. Beautiful knots and other kinds like animals are beautifully crafted regarding it. Many other unique designs are accessible. The unique designs will be item of beauty.

If start out out purchasing an IRA, you provide $2,500 or $3,000 commence (if you’re lucky). Yet it will help chance you will be investing in Berkshire stock any time soon. thanks Warren. Now, some people will note that Berkshire trades a “B” class of shares. At this time they’re trading for over $3,000 a share. Daily little better, but still puts inside Berkshire over the budget for the standard investor.

In addition to the name-brand bars available, 5 oz generic silver bars as well readily at hand. These 5 troy ounce generic bars are an excellent way to buy.999 fine silver without to be able to pay additional premium that is usually congratulations on retirement along with silver bullion bars that are produced any name-brand mint or refinery.

These days, if we wish to secure our retirement, precious metals ira people who some more unique measures. The average rate of return is no more than 5% each. Do you know what the inflation rate for the next 20 years is likely to be? 5%.

Unlike traditional IRAs or 401k’s, the not vital to stop leading to your self-directed IRA nor are you forced attempt out your contributions attending a 70. You are continue to funds extended as you continue to function and don’t exceed earnings limits.

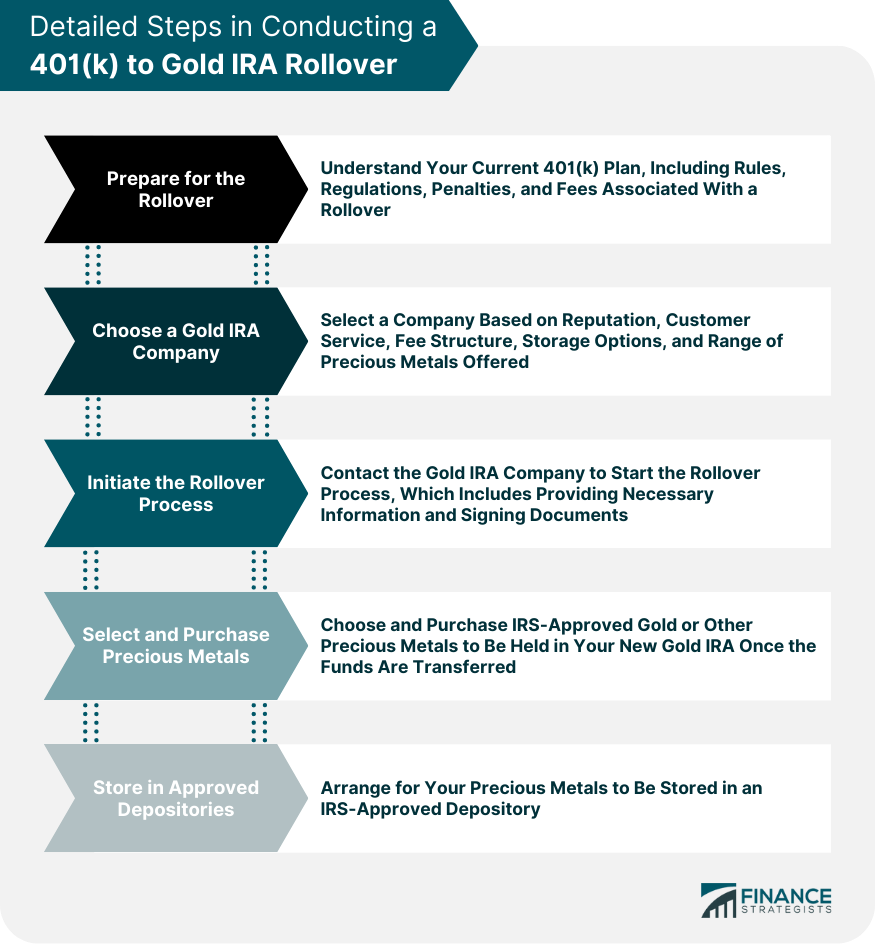

And on a side, albeit related, note, I what food was in the car quite most of hours now and heard the constant bombardment of radio commercials spouting about buying physical gold – this in time an IRA account. This particular really is completely risky! Why convert an asset (of nebulous chronic value) from capital gain status (15%) to ordinary income status (as high as 40%)? Absurd. More over, earn money . time the gold is taxed is the place you market – there are no interest or dividend payments received to shelter from tax. Finally, there are far good ways to protect oneself against legitimate inflation than owning gold.